When it comes to managing your finances, traditional budgeting tools often focus on tracking every penny spent. However, at FU Money Club, we introduce you to "The Wall," a straightforward approach that helps you visualize the monthly load you take on in your life.

What is "The Wall"?

"The Wall" is a term I came up with after facing a meltdown in my personal finances when I needed to scale my income. It refers to the wall one must climb before you can really start growing financially. It is literally a wall to overcome first before the journey can begin.

"The Wall" is designed to give you a clear overview of your recurring monthly commitments. Instead of getting bogged down by every small expense, "The Wall" allows you to see the bigger picture and understand the fixed and variable costs that impact your financial freedom.

How Does "The Wall" Work?

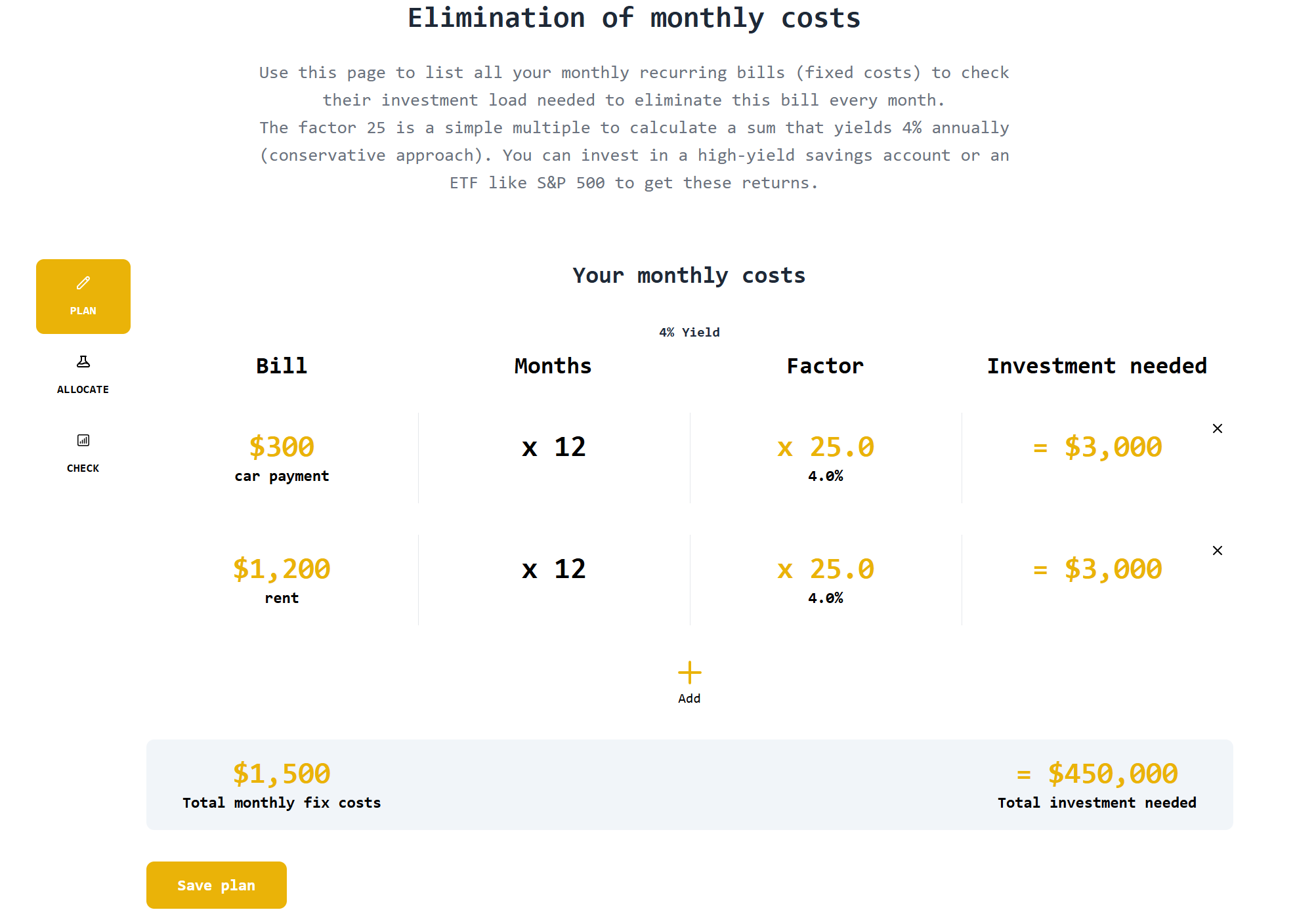

Using "The Wall," you can list all your monthly obligations, such as rent or mortgage, utilities, subscriptions, and other recurring payments. This method helps you easily identify which expenses are non-negotiable and which ones you have the flexibility to adjust or eliminate.

Why Choose "The Wall" Over Traditional Budgeting?

Traditional budgeting can be time-consuming and overwhelming, especially if you're trying to account for every single expenditure. "The Wall" simplifies this process by focusing only on the essential monthly load. This way, you can make more informed decisions about your finances without the stress of meticulous tracking.

"The Wall" empowers you to take control of your financial commitments, providing a clear path to achieving the FU money status. It’s not about restricting your spending but about understanding and managing the financial load you carry each month.

Next steps

By using "The Wall," you'll gain a new perspective on your financial responsibilities, making it easier to plan for the future and maintain the freedom to say "FU" to anything that doesn't align with your values. Start building your Wall today and take the first step towards financial independence.

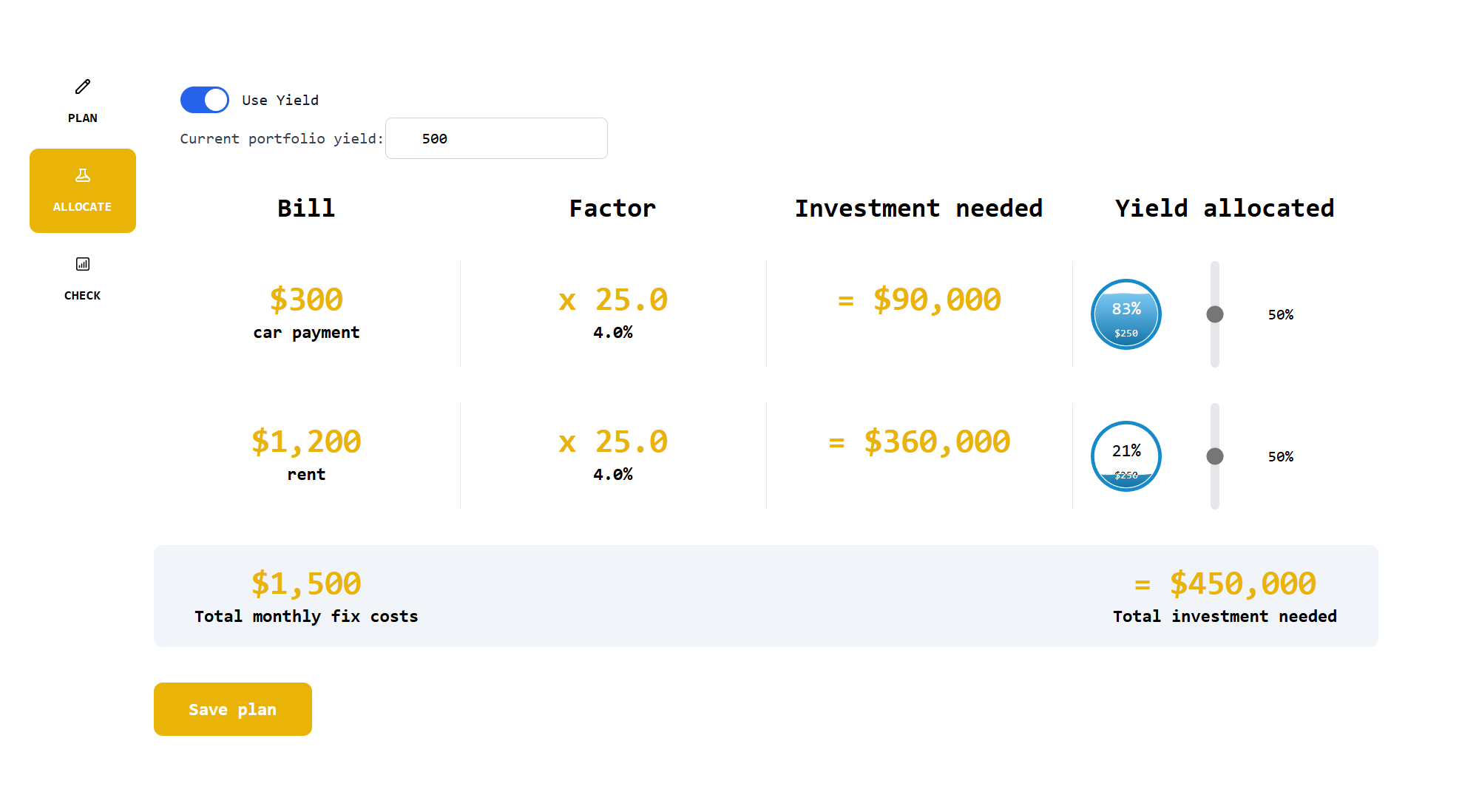

After you enter the fixed costs, you can proceed to allocate until you've climbed the wall.

The fun starts when you take a look at the Check panel, where you can insert more detailed information about your finances. All data entered is held securely, and no other member of the community can see it.

However, if you want feedback, you can share your chart with the community. Only the chart with consolidated sums is shared, not the detailed finances you have entered.